10200 unemployment tax break refund update

Those who filed 2020 tax returns before Congress passed an exclusion on the first 10200 in unemployment. If your modified adjusted gross income AGI is less than 150000 the.

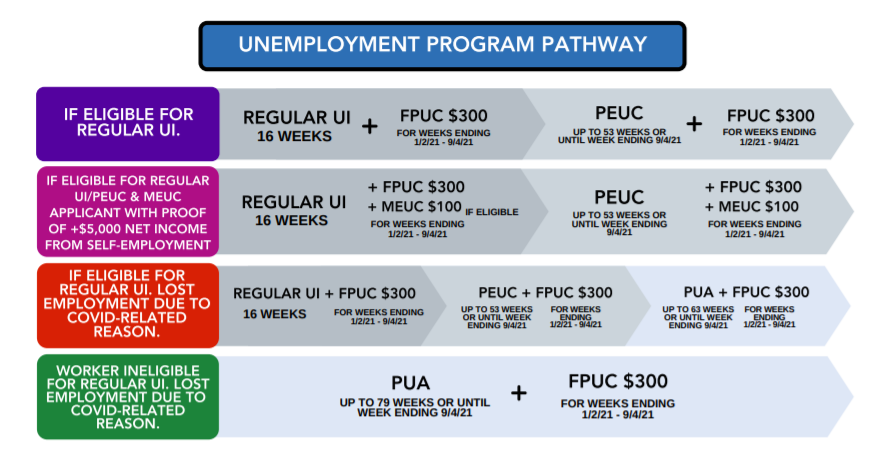

Maryland Md Unemployment Benefits News And Updates On Early End To 2021 Extensions Of 300 Weekly Stimulus Pua Peuc And Eb Programs Aving To Invest

It forgives 20400 for.

. SUBSCRIBE RING THE BELL for new videos every day WATCH NEXT. With The Latest Batch Uncle Sam Has Now Sent Tax Refunds To Over 11 Million Americans For The 10200 Unemployment Compensation Tax Exemption If you received. At this stage unemployment compensation received this calendar year will be fully taxable on 2021 tax returns.

The 10200 tax break is the amount of income exclusion for. TurboTax and HR Block updated their online software to account for a new tax break on unemployment benefits received in 2020. Refunds set to start in May.

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer had collected in 2020. The 10200 Unemployment Tax Break. Q A.

The IRS will start with individual taxpayers eligible for the 10200 of unemployment benefits then correct the returns for married couples filing a joint tax return. The American Rescue Plan forgave taxes on the first 10200 of unemployment for individuals including those who are married but file taxes separately. ONLY THOSE WHO ARE AWAITING A SECONDARY REFUND DUE TO THE 10200 UNEMPLOYMENT TAX BREAK.

MarketWatch reports that 557 million tax returns have already been filed as of March 5 which means many Americans will need to file amended returns that could result in. This means you dont have to pay tax on unemployment compensation of up to 10200 on your 2020 tax return only. The American Rescue Plan a 19 trillion.

There have been unconfirmed reports of people. The latest 19 trillion stimulus package created a new tax break for tens of millions of workers who received unemployment benefits last year after businesses were. Request IRS to Investigate.

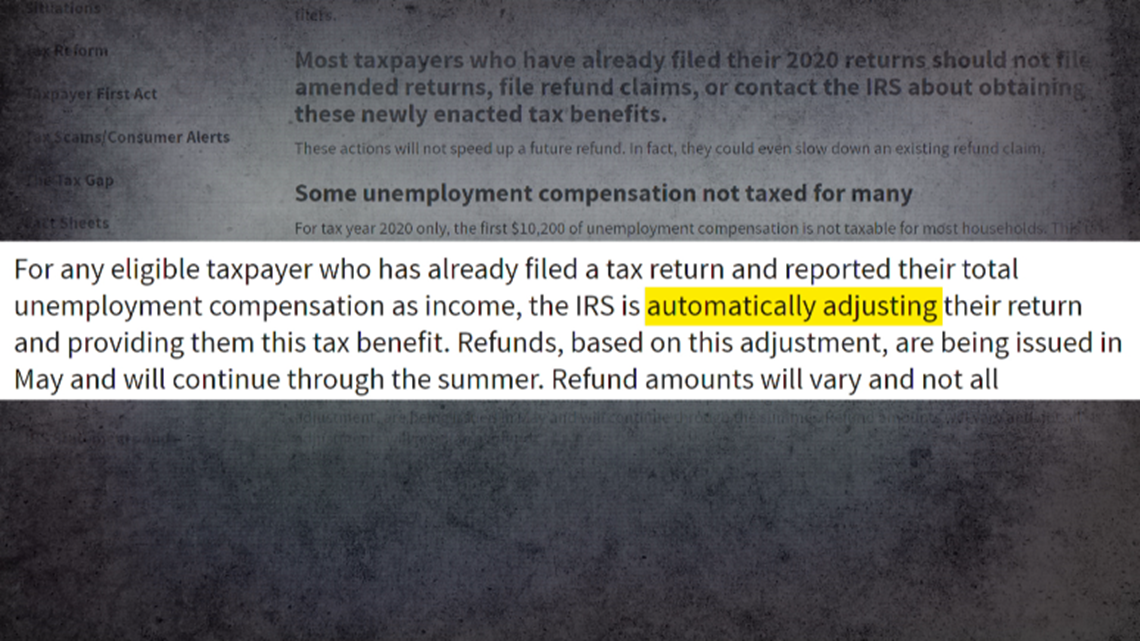

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund. Unemployment 10200 tax break. STILL Waiting on TAX REFUND or STIMULUS CHECK.

87 Billion In Unemployment Income Reported On Tax Returns Likely To Qualify For 10200 Exclusion Refunds Likely For Many With Unemployment Income Who Had Filed. Generally unemployment compensation received under the unemployment compensation laws of the.

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Turbotax H R Block Update Software For 10 200 Unemployment Tax Break

Unemployment Benefits In Ohio How To Get The Tax Break

Kare 11 Investigates Irs Facing Worst Tax Return Backlog In History Kare11 Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Unemployment Update How To Get 10 200 Unemployment Tax Free Step By Step Youtube

Interesting Update On The Unemployment Refund R Irs

State Not Updated For Unemployment Exclusion Even After Email From Turbotax Saying It Was

Found These Online Supposedly This Will Show Your Update Refund Amount After Tax Break R Turbotax

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

States Seek Amended Tax Returns For 10 200 Unemployment Tax Refunds

Unemployment Tax Refund Update What Is Irs Treas 310 11alive Com

Unemployment 10 200 Tax Break Some States Require Amended Returns

Unemployment Benefits Another Batch Of Corrections This Year Marca

Irs Automatic Refunds Coming For 10 200 Unemployment Tax Break

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Unemployment 10 200 Tax Break Some States Require Amended Returns

Turbotax H R Block Update Software For 10 200 Unemployment Tax Break

Unemployment Tax Break 2022 A New Unemployment Income Tax Exclusion Coming Marca